Do you need to review your insurance?

Since December 2020 the world has embarked upon a mass effort to vaccinate against the Coronavirus pandemic. The leading solutions have been produced by joint ventures led by Pfizer, Moderna and AstraZeneca respectively. Israel and the UAE are amongst the leaders on a per-person basis and are beginning to see a decline in the severity severity and mortality rates amongst its elderly citizens.

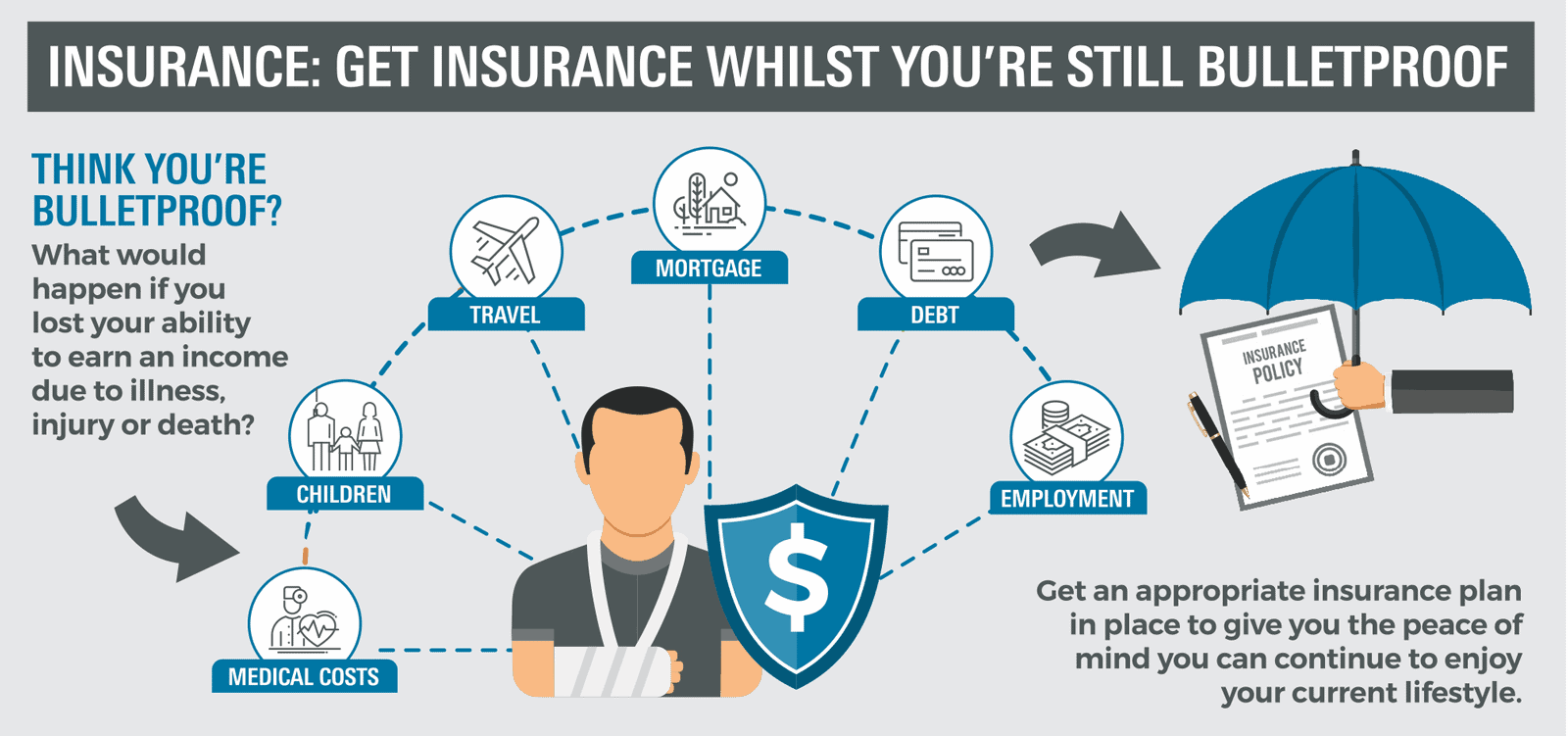

When a family experiences financial difficulty due to loss of income when an immediate family member becomes seriously injured or ill, it’s an extra stress at an already difficult, busy and emotional time. This is why appropriate insurance cover is a key consideration in any financial plan.

Some types of insurance cover can be held within your superannuation fund, and some must be standalone insurance. Holding insurance within super may allow you to fund your insurance premiums tax effectively, reducing the effective cost of your insurance premiums.

Some people also like the convenience of using their superannuation to fund their premiums rather than affecting their own cashflow. However, you need to remember that this will reduce your superannuation benefit and consider how this impacts your retirement plan, and overall financial plan.

What super can be held within super?

Not all types of insurance can be held within your superannuation fund. Generally, you can pay premiums for life, total and permanent disability (TPD) and, income protection insurance through your superannuation fund.

Whilst this can be an effective way to manage your cashflow, you need to check the type of cover is appropriate for you and will provide you with enough cover for life events that you may need to claim for. You also need to be aware of any super balance and contribution requirements by legislation, to keep your insurance within super active.

Some insurance within super will expire when you turn 65 or 70, depending on the cover.

Income protection changes effective 1 July 2021

Australian Prudential Regulation Authority (APRA) is the regulator of Life companies in Australia. APRA has determined that the Income Protection policies currently available via Financial Advisers are too generous in their terms and conditions, with claims paid far exceeding the insurance premiums received over the past decade.

For this reason, the way policies are offered to clients will change in the future. APRA will force insurers to stop offering these types of policies to new clients after 30 June 2021.

Act now and seek professional advice

A Financial Adviser can determine whether holding insurance inside superannuation is appropriate for you. They can work out what you need, what it will cost, and the most appropriate way to pay the premiums. There is also a window of opportunity right now to get a superior income protection policy that won’t exist for new clients after 1 July 2021. If you are currently working and don’t have Income Protection cover, a Financial Adviser can help you to review your current situation to determine how much cover you need and discuss with you the reasons why Income Protection might be right for you.