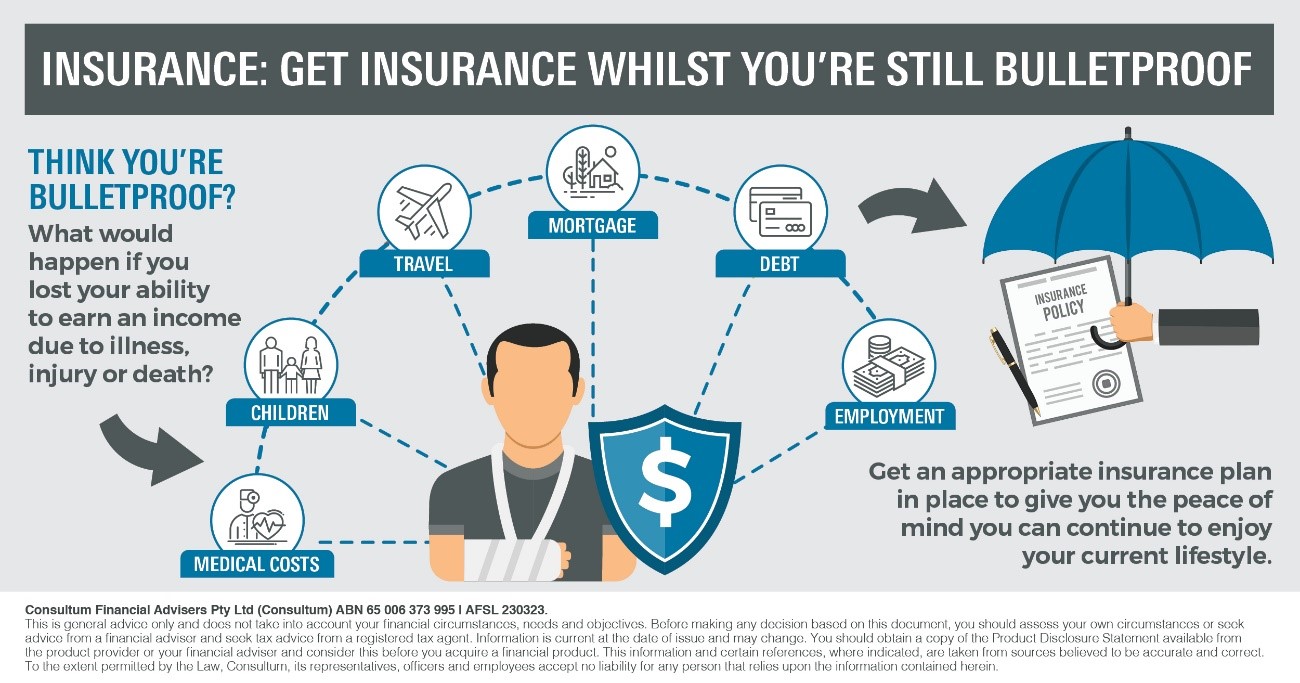

Get insurance while you’re still bulletproof

According to research by TAL insurance, the cost of personal insurance soars after the age of 35. This is also the time in our lives that you may be going through significant change such as marriage, children, a bigger mortgage and more responsibilities.

In the previous 5 years to 2017, TAL paid out insurance claims to the sum of $66m to people

aged up to 35, but this figure soared for those aged 35 – 46 to a total payout sum of $152m.

From our experience, it’s wise to get a personal insurance cover in place before you turn 35. If you are approaching your 35th birthday now is the ideal time to think about this, but it is important to stress that an appropriate insurance plan is wise

at any age.

Your financial adviser can share the technical expertise and experience required to make sure you’re properly covered.

Source: IOOF